Protecting Your New Device With Insurance

Whether you’re buying a cutting-edge smartphone, a premium laptop, or a household appliance, tech insurance provides an additional layer of protection that goes far beyond the manufacturer’s warranty. We’ll unpack how insurance can protect your tech and offer some top tips to help you find insurance that suits you.

How insurance can protect your tech

Extended coverage beyond warranty

Most devices come with a limited manufacturer’s warranty that typically covers any defects in materials or workmanship for a specific period. However, these warranties are typically short-term and are unlikely to cover accidental damage or theft. Meanwhile, tech insurance offers extended coverage for your devices, providing you with peace of mind for long after the original warranty expires.

Safeguarding against accidental damage

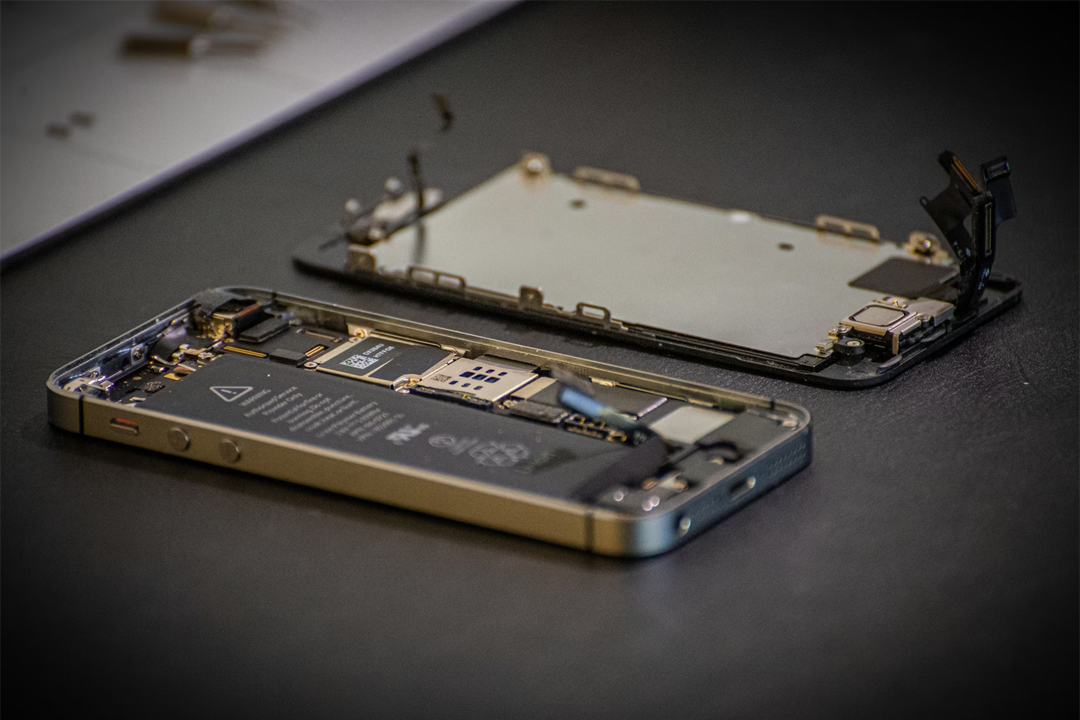

Accidents happen, but when they involve expensive electronic devices, the repair or replacement costs can be substantial. Luckily, tech insurance can cover the cost, whether you drop your brand-new phone or spill liquid on your laptop—ensuring you don’t have to bear the full financial burden.

Protection against theft or loss

In today’s fast-paced world, the risk of theft or loss can be a constant concern. Tech insurance can provide coverage if your valuable items are stolen or lost, allowing you to replace them without a significant financial setback. This is particularly useful for high-value items like smartphones, tablets, and laptops, which are prime targets for theft.

Cost-effective repairs

Repairing modern gadgets and appliances can be expensive, especially when it involves specialised parts or intricate technologies. But tech insurance can significantly reduce out-of-pocket repair costs, making it a cost-effective way to protect the lifespan of your devices.

Finding the best insurance for your tech

Everyone uses tech differently, and it can be hard to know where to start when choosing a tech insurance plan. Here are some dos and don’ts for finding the best insurance for you and your tech:

Do compare plans

It’s worth comparing your options before committing to an insurance plan. In addition to price, consider the coverage available, including accidental damage, theft, and loss. It may be a better investment to spend a little extra and have peace of mind that you’re fully covered.

Don’t forget the fine print

Terms and conditions may have a reputation for being dull—but that doesn’t mean you should ignore them. Before you sign up for an insurance plan, you should carefully read over the policy details. Look out for potential coverage exclusions (such as water damage) or limitations on the number of claims you can file.

Do consider bundles

If you love to collect all the latest devices, from smartphones and smartwatches to fitness rings, it could be worth considering an insurance bundle that covers multiple devices. This flexible option offers broader coverage to protect all your tech under a single plan.

Don’t ignore the claim process

Whether you’re choosing your plan or already have tech insurance, understanding the claims process is essential to getting the most out of your tech protection. If something happens to your tech, the last thing you’ll want to do is file an overly complicated claim. When choosing an insurance plan, you should opt for one with a fast, easy claims process so that any future claims are effortless.

Final thoughts

In this digital age, where our devices hold so much of our lives, knowing that our tech is protected can provide invaluable peace of mind. Life can be unpredictable, so it’s reassuring to know that a reliable insurance plan has you covered no matter what happens.